By: Emily Finlay

The Five Forces analysis tool is one that has helped businesses strategize and grow for over 40 years. It focuses on the profitability of your market and environment, showing the risks and opportunities available to your business.

Since making a profit is any business’ primary objective, this resource is a powerful asset in every industry. In this guide, we’ll help you understand how the Five Forces framework can change the way you view your competition and shape your business strategies. Keep reading to find tips on creating and using your own Five Forces analysis.

What is the Five Forces analysis?

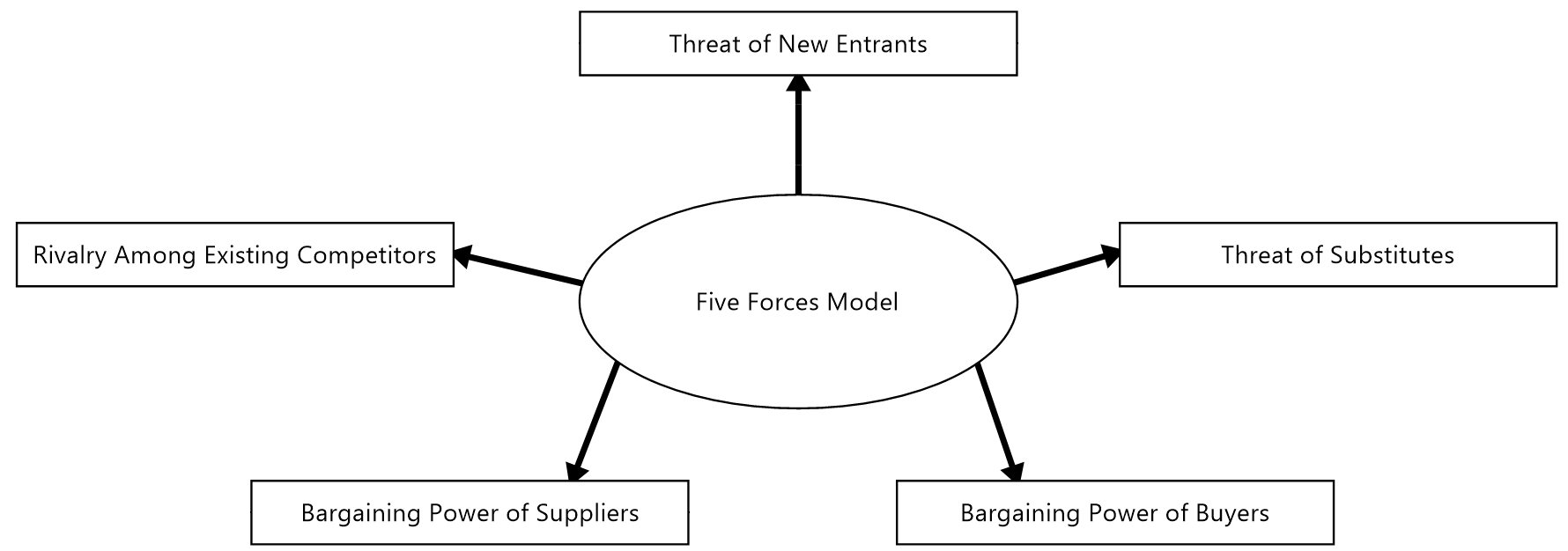

The Five Forces analysis is a tool that analyzes a business’ industry based on five factors: threat of new entrants, threat of substitutes, bargaining power of customers, bargaining power of suppliers, and competitive rivalry. Using these considerations, businesses can find the market approach that allows them to achieve an exceptional, sustained level of profitability.

Published in 1979 by Professor Michael Porter, who worked at the Harvard Business School, Porter’s Five Forces is often listed among the top business strategy resources. Rather than focusing on a micro-level business analysis, this tool provides a macro- or global-level overview of a market. Though many strategy techniques look at immediate competitors, the Five Forces analysis considers a wide range of factors (within five categories) that compete with your profitability.

Let’s dive deeper into these factors.

1. Threat of new entrants

When new companies enter an industry, the potential for profitability drops. Existing businesses lose some pricing power and often have to deal with higher production costs. The number of customers you can reach drops as their options increase. Plus, if the new company can rely on a pre-established reputation, knowledge, or cash flow, they may force smaller competitors out of business.

Within this force, there are two factors to consider: how hard it is to enter the market and how existing competition will respond to the new entrant. Some of the barriers entrants face may include:

- Economies of scale – The more supplies you purchase, the cheaper the cost per unit. New companies have lower demand, so their costs will be higher than competitors’.

- Cost of conversion – Moving from one brand to another usually incurs a cost for the customer, one few want to pay.

- Costs of starting a new business

- Limited access to sales/distribution channels – New businesses have to find and create ways to sell their products, while existing companies have established processes and industry connections.

2. Threat of substitutes

If a company finds a different way to meet a need, it can affect the success of competitors. This force specifically addresses substitutes that completely replace the existing products or process.

For example, Yeti tumblers and Ozark tumblers are competitors. Since they both meet the same need in a way that encourages overall interest in tumblers, neither is a substitute for the other. When Apple released the first smartphone, on the other hand, it replaced the need for standard cell phones. Offering so many additional capabilities to the iPhone made a simple flip phone obsolete. That is substitution.

Substitutes limit the prices and demand for the original product, forcing businesses to either develop better offerings or strategies.

3. Bargaining power of customers

Buyers can affect a company’s profitability in several ways. Customers want high-quality products, so they will choose the company that meets that need best. The same goes for prices and overall satisfaction. Buyers will always weigh price against quality against experience, so businesses have to work to come out on top of this analysis.

The customer’s power can grow even more in certain situations. In a small market, for example, each customer represents a significant percentage of the company’s sales. Lost business is a huge blow, so brands will fight harder to keep them. The more power the buyer has, the more they can influence your profitability.

4. Bargaining power of suppliers

In a similar way, suppliers can also influence your profitability. Rather than affecting your prices, however, they can force you to pay higher prices for your raw materials. If a supplier offers something you need and they are the only or best option, they can charge you more. Some of the ways suppliers can increase their bargaining power include:

- Offering something that no one else does

- Having the option to work with your competitors

- Limited distribution options within the market

- Costs of switching to a different supplier

5. Competitive rivalry

When analyzing profitability, competition is often the first thing that comes to mind. It’s important to know where you stand in your industry. Tracking the number and size of your competitors, plus their products, quality, prices, supply chain, and other important factors, reveals risks and opportunities for your business.

Companies that offer unique products may not have much competition, but they will always have the risk of a substitution or competitor product disrupting their sales. Those that have a lot of competition will have to fight harder to succeed, but they also have a larger, established audience for any potential new products.

By staying aware of your competitors, you will always be prepared to act quickly when you need to.

How to use the Five Forces analysis

When you create your Five Forces analysis diagram, you can use the factors you consider and list to evaluate your position in your market. This allows you to clearly see the threats you face, as well as the size and severity of each one. The Five Forces tool also reveals your strengths and the opportunities for growth that are available.

Once you’ve created your chart with the steps explained below, use it to adjust your current business strategies or develop new ones. This new structured way of thinking will guide you and your business to your ultimate profitability.

How to create a Five Forces analysis

The Five Forces analysis is a business diagram that helps you walk through and analyzes the five factors explored earlier. We’ve provided step-by-step instructions for creating your chart, plus examples and templates in the next section.

Building your Five Forces framework

1. Design the diagram

As you can see in the examples below, Porter’s Five Forces chart includes a central topic (Competitive Rivalry) and four arrows or circles with arrows that surround and point toward it, including:

- Threat of New Entry (Top)

- Buyer Power (Right)

- Threat of Substitution (Bottom)

- Supplier Power (Left)

You can use a tool such as MindManager to create a digital graphic that you can edit and share online. You can also use paper, poster board, whiteboards, or any other physical resource to draw your Five Forces analysis.

2. Consider each force

Choose one of the five factors and evaluate your market and business’ position based on this force. Think about your strengths and weaknesses, as well as the elements involved in each factor.

Another way to approach this step is to first evaluate your industry and business in a freeform brainstorming session, then place everything you identify under the appropriate factor.

Either way, you can then add these observations to your Five Forces analysis chart. Depending on the size of your shapes, you can either write them within the arrows/circles or beside them.

3. Tally up your observations

When you have added all of the relevant factors to the chart, determine the overall effect of each force. Then, add a symbol to each of the arrows to show the outcome, such as – for mostly negative, + for positive, and / for neutral. As long as you know what these symbols indicate, you can choose any marking that works best for you.

4. Evaluate your results

If you have mostly negative forces affecting your situation, it’s time to find ways to improve your profitability and potential in your market. For mostly positive factors, think about ways to use this advantageous position to grow. No matter the outcome, use this tool as a guide toward greater success.

Five Forces analysis use cases

So what does this look like in the real world?

Five Forces analysis example use cases

Let’s say you wanted to start a new business but you aren’t sure if it’s a good idea. Your Five Forces analysis will show if the market can bear a new competitor and if the potential for profitability is worth the risk. Even if it shows that your idea isn’t ideal, you may also learn of another opportunity that you can pivot toward instead.

If an established business wants to know if they should expand their line of products, a Five Forces analysis will show the opportunities and threats associated with this move. It might identify a substitute product that could threaten this venture. Or, it may offer the best strategy for approaching this expansion.

When it comes to determining and sustaining profitability, the Five Forces analysis is the tool to use.

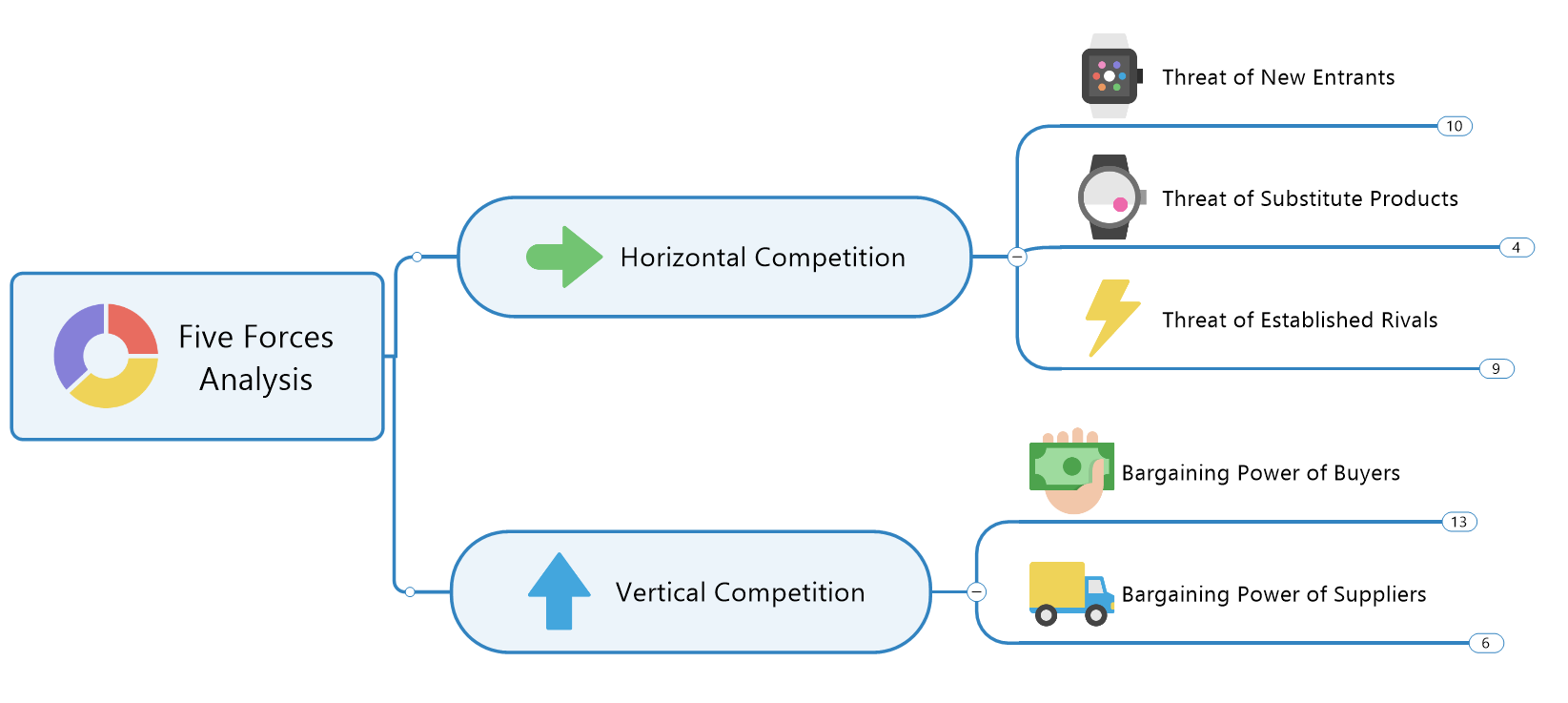

Downloadable Five Forces analysis template from MindManager

Use the five forces analysis template from MindManager below to create or inspire your own Five Forces analysis.

Click he image below to access a Five Forces analysis template created using MindManager. Click “Menu” in the bottom left corner of your browser window, and then click “Download” to get a copy of the template. Open the template in MindManager to start working.

Don’t have MindManager? No worries! Try it free for 30 days.